Prominent Canadian psychologist and best-selling author, Dr. Jordan Peterson, who commands a following of over 4.6 million on X, initiated a fervent discussion on September 14 surrounding the ongoing ‘unbanking’ trend and the potential role of Bitcoin (BTC) as a tool to supplant traditional banking systems.

This discourse was spurred by recent developments in Australia, where Macquarie Bank is phasing out services including cash, cheque, and phone payments. Peterson’s argument advocates for a shift towards Bitcoin, seeing it as a potential solution to the gradual disappearance of non-centralized mediums of exchange being observed globally, not just in Australia.

Maybe it's time to scrap

— Dr Jordan B Peterson (@jordanbpeterson) September 14, 2023

Banks

Could

Bitcoin fix this? https://t.co/j6wldXMv7P

Several nations are witnessing a decline in the usage of physical cash, with numerous European countries restricting cash transactions to small amounts, and Nigerian banks setting low withdrawal ceilings at ATMs. In light of these changes, Peterson posited that it might be the opportune moment for individuals to abandon traditional banking systems, pondering whether Bitcoin could serve as a viable alternative, especially for those seeking a cash-like experience.

Bitcoin’s Potential as a Cash Analog in Global Transactions

Earlier, Peterson had expressed an interest in leveraging Bitcoin for international financial transactions. This inclination was further nurtured when he was acquainted with Lightning Network custodial wallets by Joe Nakamoto (@JoeNakamoto), positioning him as a viable alternative to fiat-based platforms like GoFundMe for receiving cross-border donations.

Responding to Peterson’s query, several prominent figures in the Bitcoin community rallied in support. Robert Breedlove, host of the “What is Money?” podcast, chimed in, emphasizing Bitcoin’s potential to eliminate the counterparty risk that banks introduce to monetary transactions.

The conversation attracted participation from enthusiasts across various cryptocurrency networks that aim to replicate a cash-like user experience through decentralized and non-custodial methods. Representatives from networks including Bitcoin Cash (BCH), Nano (XNO), Monero (XMR), XRP Ledger (XRP), Dash (DASH), ZCash (ZCH), Litecoin (LTC), and Dogecoin (DOGE) joined the dialogue.

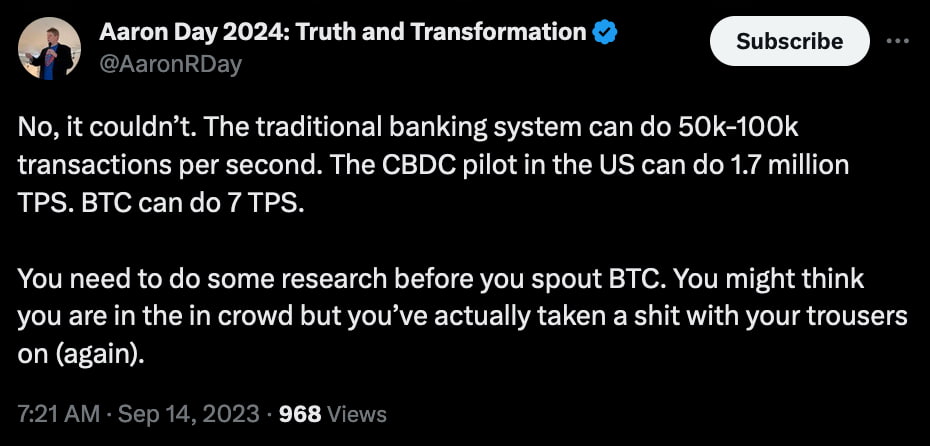

Nevertheless, the discussion wasn’t without its detractors. Aaron Day, a prospective candidate in the US 2024 presidential race, contested the feasibility of Bitcoin replacing the traditional banking infrastructure, citing its lower transaction speed compared to existing systems and Central Bank Digital Currencies (CBDCs). Despite his critique of Bitcoin’s capabilities, Day remains a vocal critic of CBDCs while endorsing the use of cryptocurrencies for creating a cash-like experience.