In the past month, the Indian Rupee (INR) witnessed substantial fluctuation against the US dollar (USD), with the latter reaching a record high of 83.44. This spike in the exchange rate was propelled by a myriad of factors, including declining oil prices and assertive remarks from the Federal Reserve which have strengthened the position of the US dollar.

Following this, the USD/INR exchange rate has seen a roller coaster of ups and downs, experiencing notable variations.

Recent events have once more swung in favor of the US dollar, with heightened strains on the INR’s trade balance serving as a significant driving force. Consequently, the USD saw an appreciation of over 0.25% against the INR in the last week, trading at 83.19 as of data collected on September 18.

Exploring the Causes Behind the INR’s Depreciation

The depreciation in the value of the Indian Rupee has been sparked by several developments. Recent reports highlighted that India’s trade deficit expanded to an alarming 10-month peak of $24.2 billion in August, a noticeable increment from July’s $20.7 billion.

Adding to the woes of the INR, the nation’s annual inflation rate witnessed a decline in August, exerting further downward pressure on the currency. A significant revelation was the decrease in inflation to 6.8% in August from 7.4% in July.

Moreover, Shaktikanta Das, the Reserve Bank of India’s Governor, anticipates a continual decrease in inflation from September onwards. This projection might pave the way for a gentler monetary policy stance from the central bank, potentially exacerbating the pressure on the INR.

In an attempt to fortify trade relations and possibly diminish reliance on foreign currencies for international commerce, India’s Finance Minister, Nirmala Sitharaman, revealed that the country is engaging in discussions with 22 nations to enable bilateral trade transactions using the Indian Rupee.

Analyzing the USD/INR from a Technical Standpoint

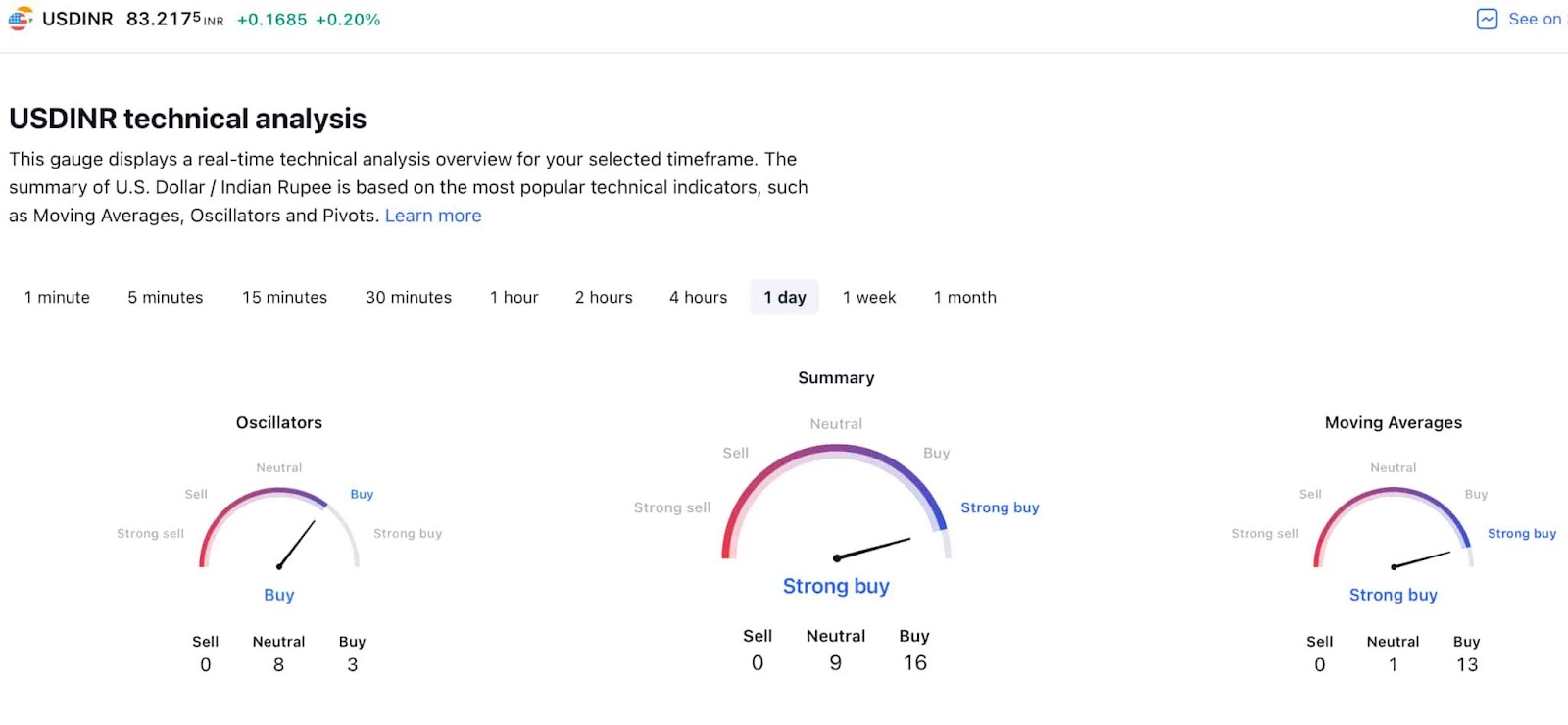

The advantageous stance of the US dollar when pitted against the INR is mirrored in the technical analysis of the currency pair.

A notable highlight is the strong recommendation to buy USD/INR as per the 1-day gauge on TradingView, characterized by 16 indicators favoring a ‘buy’ and 9 maintaining a ‘neutral’ stance. Presently, there are no indicators suggesting a ‘sell’.

This optimistic outlook is predominantly observed in oscillators and moving averages, with the latter presenting a ‘buy’ recommendation at 13 positions.

While the USD seems to be regaining its footing against the Rupee, it hasn’t been immune to recent pressures, likely influenced by the recent dip in US consumer sentiment. This downturn was substantiated by the recent release of the US Michigan Consumer Sentiment Index which stood at 67.7, a notable decline from the preceding value of 69.5, and also falling short of the anticipated 69.1.