Amidst circulating whispers surrounding the top crypto exchange, a significant quantity of Bitcoin (BTC) has been pulled from Binance. The platform’s founder and CEO, Changpeng Zhao (CZ), has described these speculations as mere ‘fear, uncertainty, and doubt’ (FUD) tactics.

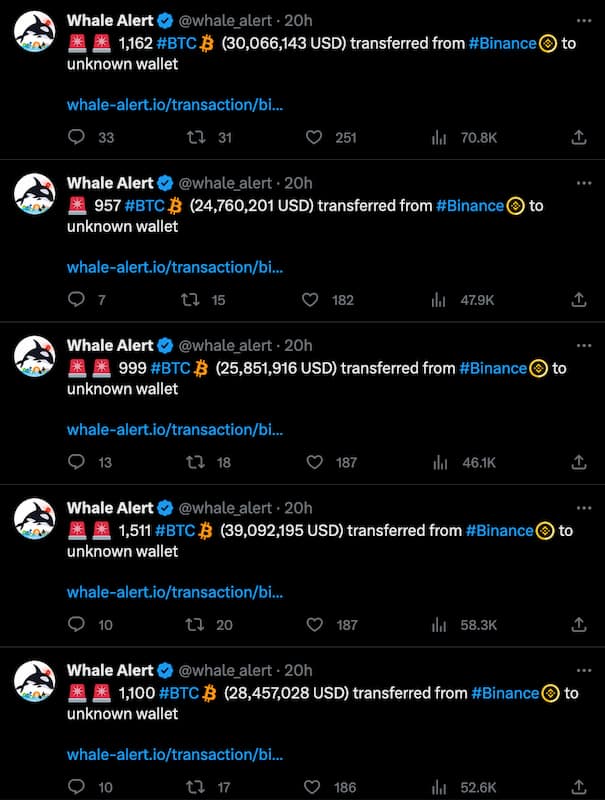

The monitoring platform, Whale Alert, flagged five withdrawals on August 23rd, all within a single minute, accumulating to 5,729 BTC (equivalent to $150 million).

Interestingly, while these withdrawals were distinct, they all found their way into the same Bitcoin block (block height 804522) causing them to be recorded simultaneously.

Several addresses were linked to these withdrawals, but one remains particularly notable. An undisclosed address, labeled as “1KNm4…rA72p”, accounted for the majority, holding 5,434 BTC at the moment of reporting.

Binance’s BTC Exodus Trend

Analysis from CryptoQuant highlighted Binance experiencing a dominant outflow trend for Bitcoin over six days starting August 17th, leading up to a staggering total withdrawal of 14,460 BTC by August 22, coinciding with a dip in Bitcoin’s price.

The daily net outflows were:

- August 17: 1,754 BTC

- August 18: 2,133 BTC

- August 19: 2,007 BTC

- August 20: 4,473 BTC

- August 21: 948 BTC

- August 22: 3,145 BTC

Netflow, in this context, is derived from the total BTC deposits subtracted by the total BTC withdrawals. The data for August 23 remains partial, notwithstanding the aforementioned 5,729 BTC withdrawal.

Exchange BTC Balances Plunge to a 5-Year Nadir

It’s not just Binance feeling the pinch of large-scale Bitcoin withdrawals. Glassnode reported a significant milestone with BTC balances across exchanges plummeting to a 5-year low on the same day as the massive whale movements.

📉 #Bitcoin $BTC Balance on Exchanges just reached a 5-year low of 2,269,235.253 BTC

— glassnode alerts (@glassnodealerts) August 23, 2023

Previous 5-year low of 2,269,719.368 BTC was observed on 22 August 2023

View metric:https://t.co/9vOOAmwh32 pic.twitter.com/jzkNkWUUYK

At present, just under 2.27 million BTC sits in known exchange addresses, suggesting that long-term Bitcoin holders, or ‘HODLers’, are transferring their assets to personal, secure wallets. Such transfers typically imply either a lack of short-term selling intent or recent purchases being shifted for safer keeping.