While most stablecoins are backed by reserves, algorithmic stablecoins use maths and incentive mechanisms to maintain their fiat peg.

Decentralized finance (DeFi) is a complex and rapidly developing industry, full of experimentation and innovation, and building on the philosophical and ideological foundations of a more efficient, censorship-resistant, and open decentralized financial system.

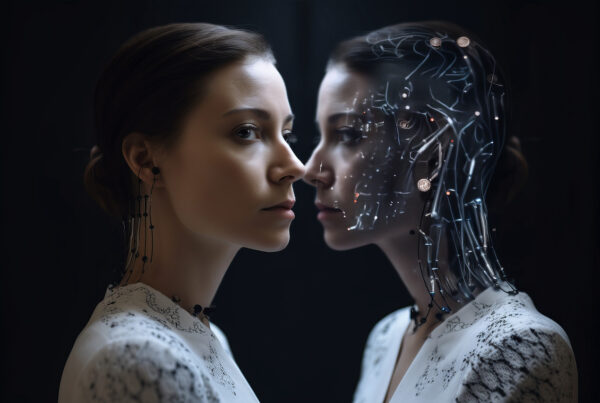

Algorithmic stablecoins exemplify these traits; part monetary economics, part financial markets, part mathematics, and part technology. Sitting at the intersection of money and blockchain technology, they are new and complex—and pose many challenges and unanswered questions over how the future of DeFi will unfold.

In this article, we’ll explore what algorithmic stablecoins are, how they work, and how they differ from conventional stablecoins.

What are algorithmic stablecoins?

Stablecoins are cryptocurrencies designed to hold a certain value relative to something else; typically a fiat currency such as the U.S. Dollar. Because stablecoins are pegged to an expected and stable value, investors or traders often use them to stay in crypto markets while protecting themselves against market price volatility.

The majority of stablecoins aim to achieve their peg using some sort of collateral mechanism. Circulating stablecoins are backed by assets whose value should guarantee the stablecoin’s value. Most major stablecoins, such as USDC and Tether (USDT), are collateralized by off-chain collateral like USD that is held with a centralized entity like a bank. However, stablecoins can also be collateralized on-chain using decentralized mechanisms, as is the case with DAI.

Algorithmic stablecoins are different. Algorithmic stablecoins, in their purest form, are completely uncollateralized. Their value is not backed by any external asset. Instead, they use algorithms—specific instructions or rules to be followed (typically by a computer) to output some result. These algorithms are optimized to incentivize market participant behavior and/or to manipulate circulating supply so that any given coin’s price should—in theory—stabilize around the peg.

How do algorithmic stablecoins work?

The litmus test to determine if a stablecoin (algorithmic or otherwise) works is simple: how well does it maintain its peg?

Algorithmic stablecoin designers use various mechanisms to help the coin maintain its peg. Unlike most stablecoins, with algorithmic stablecoins these mechanisms are written into the protocol, publicly available on the blockchain for anyone to view. Below are two common uncollateralized algorithmic stablecoin models, illustrated assuming a peg for $1.

Rebase. Rebase algorithmic stablecoins manipulate the base supply to maintain the peg. The protocol mints (adds) or burns (removes) supply from circulation in proportion to the coin’s price deviation from the $1 peg. If the coin price > $1, the protocol mints coins. If the coin price < $1, the protocol burns coins. Coins are minted into or burned from coin holders’ wallets.

Seigniorage. Seigniorage algorithmic stablecoins use a multi-coin system, wherein one coin’s price is designed to be stable and at least one other coin is designed to facilitate that stability. Seigniorage models typically implement a combination of protocol-based mint-and-burn mechanisms and free market mechanisms that incentive market participants to buy or sell the non-stablecoin in order to push the stablecoin’s price toward its peg.

A third model, fractional-algorithmic stablecoins, is becoming increasingly popular. Part seigniorage, part collateralized, fractional algorithmic stablecoins aim to maintain their peg by combining the best mechanisms from “pure” uncollateralized stablecoins and their collateralized counterparts. Frax Finance pioneered this model.

What are some examples of algorithmic stablecoins?

- Ampleforth (AMPL) – One of the first rebasing algorithmic stablecoins, pegged to the CPI adjusted 2019 USD.

- Basis Cash (BAC) – Using the 3-token seigniorage system, stablecoin Basis Cash (BAC) maintains its 1 USD peg through the use of shares and bonds.

- USDD – A decentralized stablecoin for the Tron ecosystem, launched in May 2022 by Tron founder Justin Sun.

- UXD – An algorithmic stablecoin backed 100% by a delta neutral position, on the Solana blockchain.

- UST – This algorithmic stablecoin made headlines in May 2022 when it lost its dollar peg amid a wider crypto market crash—precipitating a collapse in the price of Terra (LUNA), the cryptocurrency used to maintain its dollar peg.

The future of algorithmic stablecoins

While algorithmic stablecoins sound great in theory, they have a ways to go before they are trusted as stable stores of value. At the time of publication, no algorithmic stablecoin has managed to achieve a consistent stable peg. As such, their use cases tend toward speculative arbitrage traders.

At the same time, algorithmic stablecoins provide ripe grounds for innovation. They represent opportunities to push the bounds on what is possible in DeFi, attracting an eclectic and brilliant bunch of thinkers and builders who are innovating and iterating on existing models.

Like other stablecoins and crypto at large, the regulatory story will loom large in the algorithmic stablecoin story. More than any other cryptocurrency, stablecoins pose the biggest threat to government fiat-based money systems. Algorithmic stablecoins, with their censorship-resistant qualities, pose an even greater theoretical threat than their non-algorithmic counterparts. And lawmakers are increasingly paying attention to stablecoins; in May 2022, U.S. Treasury Secretary Janet Yellen called for stablecoin legislation to be passed as a matter of urgency.

However, questions remain over the validity of algorithmic stablecoins. Yellen was speaking in response to the May 2022 collapse of Terra’s UST and the LUNA cryptocurrency used to maintain its dollar peg, an event that severely dented confidence in algorithmic stablecoins. UST’s collapse prompted much soul-searching among advocates of algorithmic stablecoins, while some are now skeptical that they have a future at all.