The relentless litigation involving Ripple and the United States Securities and Exchange Commission (SEC) is maintaining its momentum, evoking diverse perspectives from the stakeholders as it prepares for another courtroom face-off.

During a recent discussion with Bloomberg on September 6, Chris Larsen, Ripple’s co-founder, underscored that the SEC fell short of realizing their primary aims in the court case. Noteworthily, Ripple experienced a semblance of triumph when the court adjudicated that XRP does not qualify as a security.

Larsen concurrently acknowledged the significant ramifications this legal tussle could have, not only for Ripple but also for the wider realm of cryptocurrency, marking a crucial transition phase within the sector.

“I think the bottom line is the SEC lost on everything that was important to them and important in regulation of the industry. The case still continues, or there are appeal processes that everybody has the right to do. But we think that this is really groundbreaking,” Larsen remarked.

Larsen’s comments arrive on the heels of Ripple’s resistance to the SEC’s intention to challenge the ruling. Ripple argues that the agency hasn’t satisfied all mandatory criteria to substantiate an appeal in the ongoing case.

SEC’s Lawsuit Negatively Affecting XRP

John Deaton, a prominent attorney advocating for XRP, conveyed through an X (previously Twitter) message on September 7, that XRP sustained setbacks owing to the SEC’s lawsuit, despite the initial court decision favoring the digital currency.

“The damage to XRP’s adoption in the United States is very significant. <…> Because the SEC was claiming XRP was a security, including secondary market sales, independent of Ripple, and Coinbase needed the SEC’s approval to go public and issue an IPO, Coinbase felt compelled to suspend/delist XRP from its platform,” he elaborated.

Deaton, who foresees the possibility of a court trial in 2024, has hinted at the potential for a settlement between the engaged entities. He noted that a judge’s consent to dismiss the Coinbase case would signify that transactions orchestrated on the platform do not come under the purview of the American securities regulations.

In the event of an affirmative dismissal, this would substantially curtail the SEC’s scope to advocate an appeal, steering the parties towards a plausible settlement agreement.

Brad Garlinghouse, the CEO of Ripple, had earlier indicated that any resolution prior to the summary judgement would hinge exclusively on the SEC’s confirmation that XRP is not governed by security regulations.

XRP Market Overview

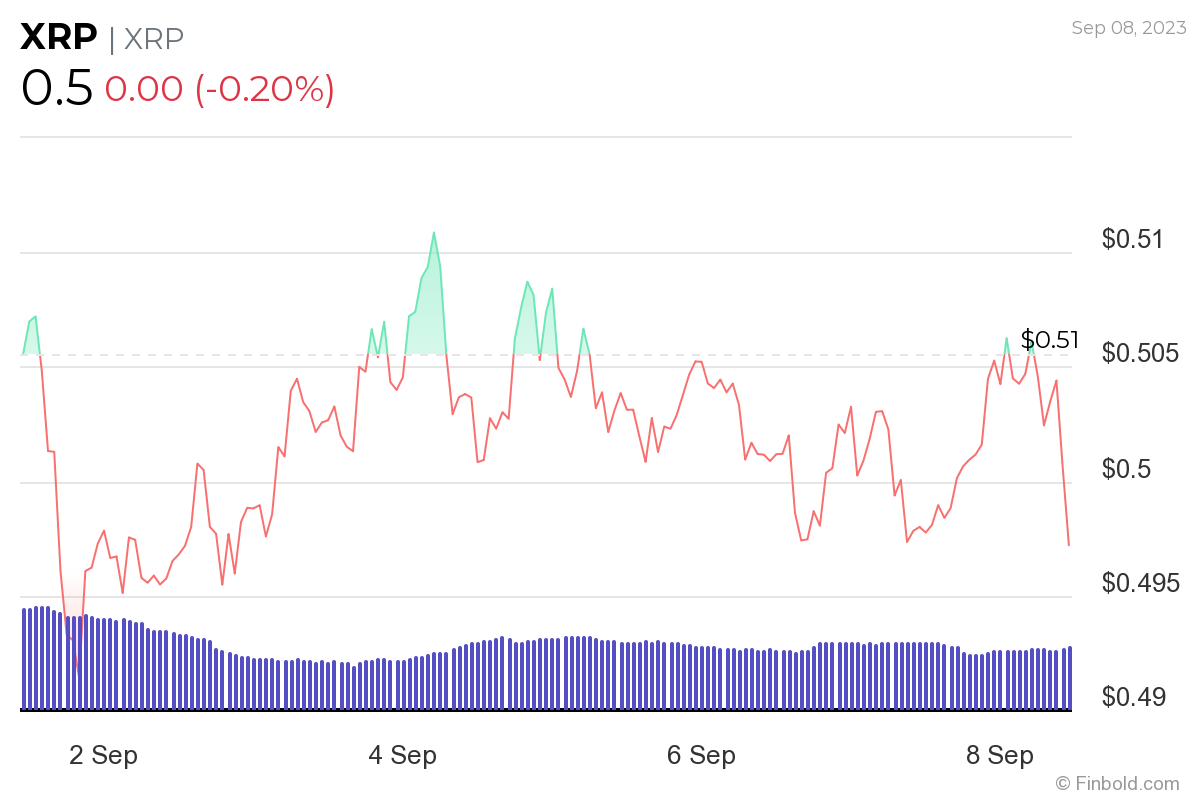

Simultaneously, XRP is maintaining a stable trading pattern, echoing the overall trends observed in the cryptocurrency market sphere. At the moment of this publication, XRP was trading at an evaluation of $0.50, registering a slight daily decrement of around 0.20%.