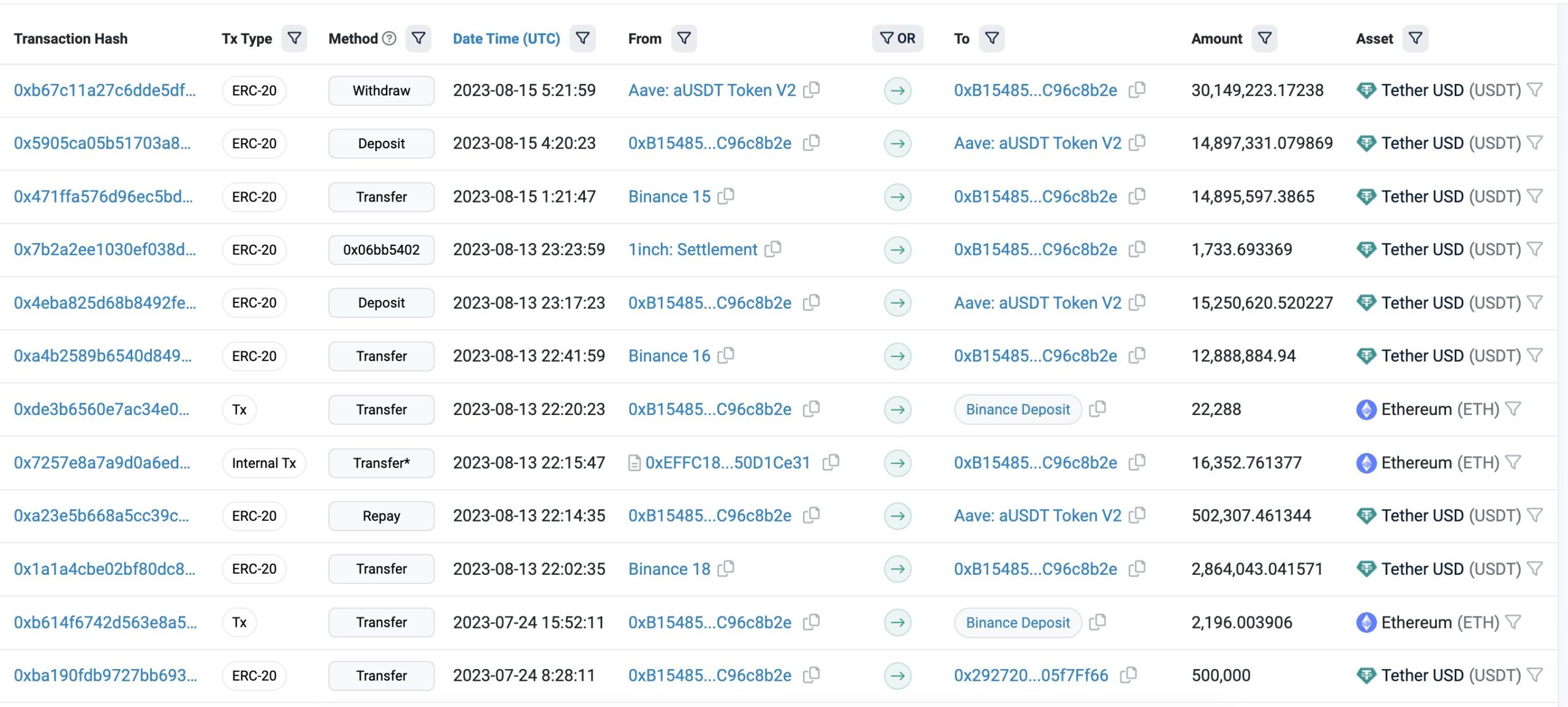

An individual possessing a significant amount of Ether (ETH) offloaded assets worth $41 million just days before a sharp market downturn, thereby evading a possible $5-million drop in value.

The substantial transaction came to light through Lookonchain, a blockchain analytics tool that tracks and highlights insightful trades. Records from Aug. 18 show the said individual moved 22,341 ETH to the Binance exchange, later withdrawing approximately $41 million in Tether (USDT).

By making this move, the crypto investor endured a loss of about $1.7 million. However, this action also staved off additional potential declines amounting to over $5 million, as market figures plunged shortly thereafter. On that same day, the entire crypto market’s capitalization diminished by 6%, settling at $1.1 trillion – the lowest in roughly two months.

Ether, recognized as the second-biggest cryptocurrency by market value, saw its price fall from approximately $1,820 per unit on Aug. 17 to around $1,597 the following day. Concurrently, Bitcoin (BTC), which represents nearly half of the total crypto market’s value, dipped from roughly $28,400 to $25,649. It later regained some ground, surpassing the $26,000 mark within hours.

This downward trend coincided with a piece by The Wall Street Journal noting that Elon Musk’s company, SpaceX, reported a $373 million decline in the value of its BTC holdings between 2021 and 2022. The exact nature of this reduction – whether it was a sale or merely a valuation adjustment – remains ambiguous.

SpaceX’s BTC valuation revision sparked debate and speculation within the crypto sphere. Differing narratives emerged in the media; some suggesting a complete liquidation of the firm’s Bitcoin, while others felt the precise amount sold was indeterminable based on the article’s phrasing. Users on X (previously known as Twitter) critiqued Musk directly, branding him with “paper hands” – a slang term implying a lack of commitment to holding onto cryptocurrencies for the long run.