Some of the most promising technological, economical and political advancements are currently being developed by the blockchain and cryptocurrency industry, yet the technology is still not well understood by regulators and the general public. As a result, scammers across the world are taking advantage of the novel technology to prey on uneducated consumers.

Here’s a short guide to spotting these types of crypto scams, as well as a brief overview of the industry and its technology.

How to Spot a Ponzi Coin

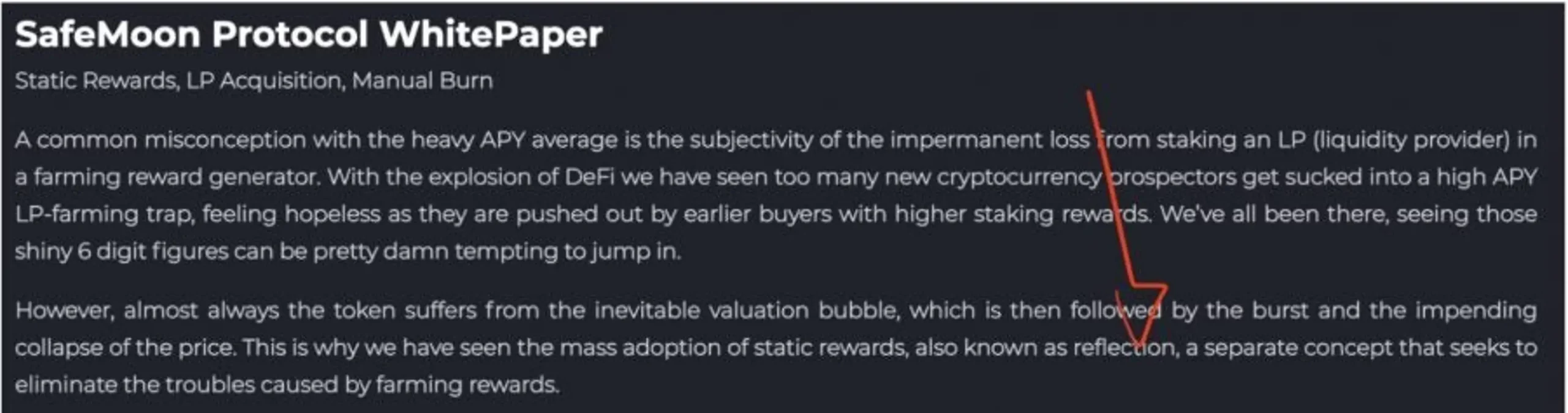

Ponzi coins like SafeMoon, Baby Doge Coin and FEG token require users to pay a redistribution or reflection fee for selling and sometimes transferring coins. These coins typically live on the Binance Smart Chain, although many are based on Ethereum. Usually, a portion of the fee is “burned” or removed from circulation. By doing this, projects claim to be revolutionary “deflationary” currencies when in reality they’re not doing anything novel at all.

The rest of the fee that isn’t burned is distributed back to the holders of the token, proportional to their share of the total supply. The project owners will then describe that return as a source of “passive income” when the majority of the money is actually going to creators who hold the largest slice of the pie. While these wealthy few sit back and sell off their earnings, the token loses its value as the passionate community refuses to sell (and pay the huge tax) and becomes broke. Another thing to look out for is a portion of the redistribution being given to charity. These projects often do this to disguise their intent.

Other Quick Tips

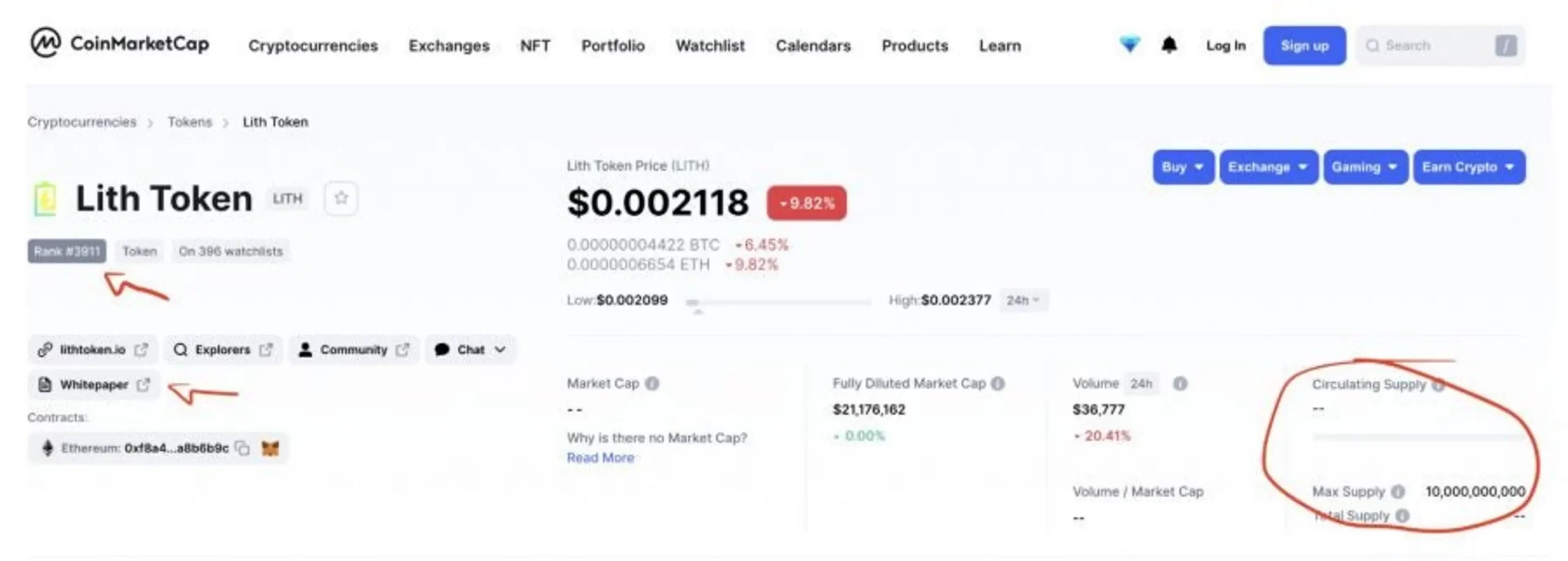

- Check CoinMarketCap.com to see the coin or projects ranking. Anything outside of the top 1,000 is usually not worth bothering with.

- Find the whitepaper. A whitepaper will tell you all about the coin and can usually be found on CoinMarketCap.com. Skip to the section called Tokenomics and look out for any sort of redistribution fee.

What Is Blockchain?

A blockchain is a public, internet-based database or computer. People all over the world known as “miners” contribute their computer’s resources to the blockchain network for profit. Users pay to tap into this global computer because of the benefits afforded by its decentralized nature.

Not all blockchains are created equally, however, as many of them are controlled by only a few powerful players. “Nodes” are full copies of the entire blockchain. Each node must contain an identical copy of the blockchain, and these nodes must always communicate and reach consensus on recent events. These recent events could be transactions or smart contracts, but whatever it is, they are grouped in timed intervals (blocks) and “chained” together.

Bitcoin’s block time is around 10 minutes, whereas Ethereum’s is closer to 15 seconds. At the end of each block, the current state of the database (the updated wallet balances after a batch of transactions) is finalized via consensus. Should a few of the nodes try to slip themselves a few extra BTC, their proposed version of the block will be discarded by the group at large. This solution is possible because the individual actors across the network stand to make profit only from being honest. Dishonesty is achievable only by corrupting 51% of the entire network power (51% attack). For big blockchains a 51% attack is uneconomical; however, small blockchains like Ethereum Classic are successfully attacked often.

After trust in traditional finance collapsed post-2008 financial crisis, an anonymous person using the name Satoshi Nakamoto realized the need for a trustless store of value. The magic of blockchain is that when a network of individual actors at large are properly incentivized, the need for trust is theoretically removed. Satoshi realized that a blockchain-based, trustless ledger (like the ledgers all the centralized banks use to keep track of account balances) would solve the problem. That is Bitcoin.

A few years later, Russian programmer Vitalik Buterin took the powers of decentralization to the next level. Instead of a payment ledger, what if a blockchain was a general purpose virtual machine functioning as a place for developers to create all sorts of apps that can take advantage of decentralization execution? This is Ethereum. Developers were quick to pick up on the implications of this ecosystem and began rebuilding the entire financial ecosystem on the blockchain. The result is called decentralized finance, or DeFi, and while it’s only 5 years old, it’s already empowering the 40% of the unbanked global population and threatening to end traditional finance as we know it.

What to Look for in a Solid Crypto Project

The best cryptocurrency projects are not the ones claiming to be revolutionary but those with billions of dollars of transaction volume already flowing through their app or blockchain.

It’s important to understand whether a project is its own blockchain or an app built on another blockchain. A few examples of independent blockchains are Bitcoin, Ethereum, Solana, Cardano, Cosmos and Polkadot. Each blockchain has its own DeFi ecosystem, provided they can handle smart contract execution (Bitcoin doesn’t and Cardano will soon).

The most popular apps (by transaction volume) on the Ethereum blockchain are OpenSea (non-fungible token or NFT platform), Uniswap (exchange) and Axie Infinity (NFT game). Let’s take a look at decentralized exchanges (DEXs) to get an idea of a solid fundamental blockchain application.

Decentralized Exchanges

A DEX like Uniswap allows users to swap between currencies based on the Ethereum blockchain (other DEXs exist on other chains and let users swap that chain’s assets as blockchains are not interoperable yet). Liquidity for any given swap is also provided by users, called liquidity providers (LP), who earn the swap fee for providing the liquidity. Because the process is anonymous and decentralized, it allows users to realize gains in stablecoins like USDC without using a centralized exchange. Selling this magically appearing USDC for fiat with Coinbase, however, will require some explaining to the IRS.

Crypto’s Future Is Hard to Predict

Cryptocurrency and blockchain have already changed the world in a significant way. The thing about blockchain is that once it’s out of the bag, it’s really hard to stop. To shut down a blockchain like Bitcoin or Ethereum, all governments of the world would need to come together, agree and execute a highly technical mission swifty.

Alright, here comes some dubious speculation. In all likelihood, governments are about to lose their monopoly on money. Bitcoin is likely to become the global reserve currency, and governments across the world will begin running their own nodes to stay relevant in the blockchain based global economy of the future. Ethereum will become the global settlement layer, and other blockchains like Cardano and Polkadot will have plenty of demand for their chains as well. The lofty goals of Web3 will be realized with Ethereum and individuals across the globe will come to have unprecedented levels of financial freedom. Either that, or it’s tulip mania.