Cryptocurrency transactions are subject to Income Tax in Germany. The German Federal Central Tax Office or Bundeszentralamt für Steuern (BZSt) has set out strict guidelines on how cryptocurrency buying, trading and mining is taxed. This guide breaks down everything you need to know about individual crypto taxes and how you can avoid notices, audits and penalties later on. We’ll also explain how to calculate your crypto taxes, the forms you need and give you tips on how to reduce your tax bill.

This guide is regularly updated

One last thing before we start – the rules on crypto tax are in constant flux. At Koinly we keep a very close eye on the BZSt’s crypto policies and regularly update this guide to keep you informed and tax-compliant.

Crypto taxes in Germany

Cryptocurrency is viewed as a private asset in Germany, which means it attracts an individual Income Tax rather than a Capital Gains Tax. The key thing to know is that Germany only taxes crypto if it’s sold within the same year it was bought.

So while Germany taxes certain crypto events, like short term trades, mining and staking rewards, its tax rules on crypto are far more lax than in other countries. That’s because bitcoin and other crypto is not treated as property under the German Tax Acts.

Instead cryptocurrency is classified as ‘other assets’, and selling it is a ‘private disposal.’ This distinction is important since the private sale of assets holds tax benefits in Germany. As a ‘private sale’ in Germany crypto gains are completely tax-exempt after a holding period of one year.

In addition, profits on crypto sales up to 600€ per calendar year remain tax-free.

Crypto traders who use cryptocurrencies for long-term financial investment and do not often relocate them, can thus generate tax-free profits in Germany.

German Income Tax Rate

In Germany your individual Income Tax rate is used to tax short term cryptocurrency gains.

As well as income tax, everyone has to pay solidarity tax (Solidaritätszuschlag or ‘Soli’), which is capped at 5.5% of income tax.

This surcharge is imposed as a percentage on all individual income taxes. .

| Tax rate | Single Taxpayers | Married Taxpayers |

|---|---|---|

| 0% | Up to 9,744€ | Up to 19,488€ |

| 14 – 42% | Up to 57,918€ | Up to 115,836€ |

| 42% | Up to 274,612€ | Up to 549,224€ |

| 45% | More than 274,612€ | More than 549,224€ |

Short-term and long-term gains in Germany

The decisive factor for whether taxes are due on a cryptocurrency or not is the time of purchase and sale, i.e. ultimately the holding period. Crypto investors who have Bitcoin, Ethereum and other crypto in their wallets for more than a year can initially sit back and relax, because in this case, no crypto tax has to be paid due to the minimum holding period of 1 year.

When it comes to cashing in on staked crypto, that tax-free holding period is a minimum of 10 years.

When will you not pay tax on crypto in Germany?

If you have owned crypto for over a year, the sale is tax-free regardless of the amount you profit when selling.

You won’t pay tax on crypto gains:

- If you sell your crypto after owning it for 1 year or more.

- If the total profits from your crypto are less than 600€ per annum.

When will you pay tax on crypto in Germany?

You’ll only pay tax, as ‘other income’ on crypto gains:

- If you sell crypto in the same year you bought it and realise a profit over 600€.

- If you sell crypto used in staking/lending protocols within one year.

- When you’re mining, staking or otherwise earning an income from crypto.

Which tax will you pay in Germany?

Unlike Australia, Canada, UK and the USA, Germany doesn’t have any particular separate Capital Gains taxation policy. When private individuals buy or sell crypto the type of tax they’ll need to pay – when applicable – is Income Tax, as outlined throughout the German Income Tax Act.

If you’ve bought or sold cryptocurrency in the last financial year, you will need to declare your crypto totals on your Income Tax Return. You will need to declare this as ‘other income’ on a separate form to your main income declaration form.

How does the BZSt know about my crypto?

If you have an account with a European digital currency exchange, then it’s likely that the Bundeszentralamt für Steuern (BZSt) already has your data.

When the European Union’s Sixth Anti-Money Laundering Directive comes fully into force on June 3 2021, every company that provides financial services to cryptocurrency customers and businesses will have to comply with much tougher regulations about when and how they identify customers. Data is made available between EU member states in a bid to stamp out money laundering and illegal activities.

The new EU directive on data sharing – Dac8 – which will likely take effect later this year will give the Bundeszentralamt für Steuern the ability to check whether someone owns crypto. Under the proposed directive – it’s likely the German tax office will have the authority to look into crypto companies’ accounts and gain insight into crypto assets.

German Tax Deadline

The German tax year runs from January 1 to December 31. Technically, the tax deadline is on the 31st of July each year. However, if this falls on a weekend it will fall to the next working day. If you are completing your tax return for 2021, it needs to be filed by 1st of August 2022.

How do you report crypto tax in Germany?

The BZSt wants to know about your crypto activity in terms of income and profits made from crypto trades, swaps and sales. You’ll need to declare this in your annual tax return (Einkommensteuererklärung), in the same way you need to report your regular income, gains and losses.

Once you, or your accountant has calculated your German crypto tax (we have an app for that!), the easiest way to file your taxes is via ‘ELSTER’, the BZSt’s online tax platform (Elektronische Steuererklärung).

You also have the option of declaring your crypto activity on paper and posting your tax forms to your local tax office (Finanzamt).

German Crypto Tax Filing Forms

To file your German cryptocurrency tax, you’ll need 2 forms, one for general income, Hauptformular ESt 1 A, and one for your crypto income, Anlage SO.

Hauptformular ESt 1 A (General Tax Form) – 2020

WHO NEEDS TO FILE THIS?

Any German resident who has earnt income or made capital gains (not just from crypto).

WHAT INFORMATION IS NEEDED?

This form requires you to enter your regular income tax information.

Hauptformular ESt 1 A (general tax form): This details your regular income such as a salary and your German bank account information.

Anlage SO (For other Income) – 2020

WHO NEEDS TO FILE THIS?

Anyone who has traded in cryptocurrency in the last financial year.

WHAT INFORMATION IS NEEDED?

This form requires you to enter all your crypto income totals (income and gains).

Anlage SO (Other income tax form): You must declare your profit from trading in cryptocurrencies in Annex SO (Other Income).

Keep records of crypto investments

Most tax offices around the world require residents to keep detailed records of cryptocurrency transactions for 5 years. Germany is no different. It’s advisable to keep the following records:

- the date of your crypto transactions

- the value of the cryptocurrency in Euro at the time of the transaction (which can be taken from a reputable online exchange).

- what the transaction was for and who the other party was (even if it’s just their cryptocurrency address).

Koinly can help with record keeping. By syncing your wallets and exchanges to your Koinly account, you will have one central dashboard from where to record and view all of your crypto activity. Portfolio tracking is available on a FREE Koinly plan.

Help calculating German crypto taxes

Crypto tax reporting is fairly new, and a road less traveled for most accountants. That doesn’t mean the German taxman is going to cut you any slack. Here are 4 ways you can tackle your crypto taxes and keep in the BZSt’s good books. We’ll start with the easiest and most accurate method first.

- Use a crypto tax calculator like Koinly to create a report of crypto activity. Send the report to your accountant to complete your tax return. Super accurate, super easy.

- Use a crypto tax calculator like Koinly to create a report of crypto activity. Add the necessary data to your tax return and file it yourself. Accurate, and easy, if you know what you’re doing.

- Get your accountant to work out your crypto activity by supplying transaction histories, statements, etc. Let them work it out and file for you. Not very accurate, lots of admin.

- Work out your activity yourself, and file yourself. (Best of luck to you.)

How to use a crypto tax app like Koinly to calculate your German tax

Don’t get stuck in the busywork. Don’t get it wrong. Don’t rely on your accountant to know where to look. Use Koinly. Here’s how easy it is:

- Sign up for a FREE account.

- Select your base country and currency.

- Connect Koinly to your wallets and exchanges. Koinly integrates with Binance, Bitwala, CoinSpot, CoinJar, Kraken, Swyft, and 300+ more. (See all)

- Let Koinly crunch the numbers. Make a coffee.

- Ta-da! Your data is collected and your full tax report is ready!

- To download your crypto tax report, upgrade to a paid plan from $49 per year.

- Send your report to your accountant, or complete your tax submission yourself, using the figures from your Koinly report.

Now that you know how to go about calculating and submitting your taxes, let’s explore Germany’s bitcoin & crypto tax rules in more detail.

Income Tax vs Tax Free

As we mentioned earlier, most cryptocurrency transactions fall under the income tax regime which requires you to pay a tax on the profit/loss from your trades.

Cryptocurrencies (e.g. Bitcoin, Ethereum and others) are legally not defined as “currencies” but as property (as in “object”) in Germany. Therefore, buying bitcoins is like buying art, music, or other items.

When trading cryptos privately, it is regarded as any other private trade, for example like selling your car. In a private trade in Germany, you only have to pay taxes on any profits you generate with that trade and only if you sell that item within one year of buying it.

Remember that crypto mining is viewed as a business activity and is taxed under a different tax system than Income Tax.

Here’s a summary of how your crypto activity is likely to be viewed the BZSt:

- Tax type 1: ‘Other Income’ tax: profit exceeding 600€ from crypto sold within the same year of crypto purchase, using crypto to buy items within the same year of crypto purchase and ‘earning’ crypto through mining or staking.

- Tax type 2: Tax free crypto events include buying crypto, token & coin swaps and moving crypto between wallets that you own as well as gifts & donations, airdrops and crypto profits gained after 1 year of purchase.

Here’s a breakdown of the most common crypto scenarios and the type of tax liability they result in:

Taxed Crypto Transactions

Cryptocurrency interest income, staking income, and hard forks are taxed as income only when gains are made past a specific holding period. Here’s a breakdown of the most common crypto scenarios where income tax applies:

Selling crypto over 600€ within 1 year

In Germany, if you sell bitcoins or any other cryptocurrency within twelve months of buying, you will need to pay income tax. When trading cryptos privately, it is regarded as any other private trade, for example like selling your car. In a private trade in Germany, you only have to pay taxes on any profits you generate with that trade and only if you sell that item within one year of buying it.

This means that whenever you sell something that you have owned for more than one year, you do not have to pay taxes on the profits you generated with that trade.

To avoid this, you would need to a) sell for under 600€ or b) wait for a year to pass before you sell.

EXAMPLE

Hilda buys 0.1 Bitcoin in July for 1,000€ and sells it in November for 1,800€. As she has sold her crypto within the same year as buying it and the profit exceeded the 600€ tax-free cap. Hilda has effectively added 800€ to her annual income. She will be taxed on this gain, according to her Income Tax bracket.

Trading or exchanging crypto

Trading one crypto for another (i.e. BTC → XRP) is a taxable event in Germany if a profit is made exceeding 600€, and if that gain is made in the same year as the initial crypto purchase was made.

Trading with stablecoins

A stablecoin – like TrueUSD or EURB, is simply a class of cryptocurrency that offers price stability. That’s because stablecoins are backed by a reserve asset, usually a stable fiat currency like USD or EUR. The sale of a stablecoin will attract tax if the value exceeds

There is no major advantage or disadvantage between trading with fiat and trading with a stablecoin when it comes taxes. Like with all disposals, stablecoins will attract tax only if they are traded in one year, and if the profit realised exceeds 600€

Participating in an ICO/IEO

ICOs (Initial Coin Offerings) or IEOs (Initial Exchange Offerings) refer to a situation where investors can purchase tokens/coins in a yet-to-be-released cryptocurrency/company. This purchase usually happens via an existing cryptocurrency likes Bitcoin or Ethereum.

From a German tax perspective, this could amount to a crypto-to-crypto trade. The taxable event is triggered on the date of the ICO transaction, when you receive the new tokens. When you sell the new tokens at a later date, the cost base of that transaction will be the value of the cryptocurrency that you paid for it on the date of the ICO/IEO.

You will only be taxed if you dispose of the new coins within a year from purchase.

Margin trading

Margin trading with crypto involves borrowing funds from an exchange to carry out your trades and then repaying the loan later. There is usually some interest involved as well.

There is currently no guidance on how this is taxed however it is important to note that there is a clear difference between margin trading and trading with futures, so the rules that apply to futures trading/speculation may not apply to margin trades.

On a futures trade you are speculating on the rise/fall of a coin, on a margin trade you are borrowing funds to carry out some trades. Most exchanges have different platforms for both, for ex. Binance allows margin trading on spot markets, whereas you have to trade on a completely different platform if you want to do futures as well – Binance Futures.

Taking this into consideration, the conservative approach is to simply treat borrowed funds as your own investments and pay CGT on the repayment of the loan (since this would be deemed a disposal).

Spending crypto within a year

Purchases of goods and services with crypto are treated the same as trading crypto in Germany. For example, if you acquire 7,000€ worth of ETH and purchase a gaming PC with that crypto when it’s now all worth 9,000€, you will be taxed on the 2,000€ net gain on that crypto as if it were income.

You could, however, avoid this tax if you held the ETH for a year before making your purchase. Gains after one year of purchase are tax free.

Selling staked/loaned crypto within 1 year

If you use a staking or lending protocol (or indeed a non-custodial wallet for staking as part of a PoS consensus mechanism), the tax rules change. Prior to April 2022, if you sold crypto used in a staking or lending protocol within 10 years, you’d pay Income Tax on that crypto. However, this has now been changed to a 1 year holding period. So if you sell crypto you’ve used in a staking or lending protocol within 1 year, you’ll pay Income Tax on any profit from that crypto.

Getting paid in Bitcoin

Whether you are freelancing or working for a company that pays employees in crypto, you can’t escape income tax.

Any crypto – BTC or otherwise – received as income are taxed at market value at the time you received them so make sure you declare this income on your annual tax return or you might end up facing the tax hammer.

Exchanging crypto for fiat currency

Converting cryptocurrencies into fiat currencies (e.g. Euro or USD) or into other cryptocurrencies is regarded as a sale. In the case of converting Bitcoin into Ethereum, be careful to wait until you have owned the Bitcoin for at least one year. Otherwise, you would need to pay taxes on any profits at the time of conversion.

Futures/contracts/options trading with crypto

In futures trading, you are not actually buying or selling any crypto. Instead you are speculating on the rise or fall of the price of a crypto asset in the future. When you close your position, you will either make a profit or a loss (P&L). Depending on the scale at which you’re doing this – this may be subject to income tax – regardless of how long you hold your asset for.

Note: If you are using Koinly to calculate your taxes then you can control how the P&L is taxed on the settings page.

Sign ups and referral bonuses

Any crypto you get in return for signing up or referring users to a service is taxed as Income.

Tax Free Crypto Transactions

The major thing to remember is that crypto trades are tax free under 2 conditions: if the profit made is less than your 600€ tax-free cap, and if a sale/swap/trade happened 1 year after the related crypto was purchased.

Selling crypto held for over a year

In Germany, if you’ve owned crypto for over a year – the sale is tax-free regardless of the amount you profit by selling them. Furthermore, you don’t need to declare them in your tax return!

Gifting crypto to friends & family

Giving Bitcoin or other crypto to your family or friends as a gift is regarded as any other gift in Germany. Gifts are tax-free up to a value of 20,000€ for friends and up to 500.000€ for spouses. Any higher value is taxable under the “Schenkungssteuer”, which has different tax rates depending on who you gift it to (i.e. spouse, your children, your parents, your siblings, or friends). The tax rates for gifts range from 7% up to 50%. The tax exemption limits are renewed after 10 years.

Selling Crypto for under €600

In Germany, if you sell bitcoins or any other cryptocurrency within twelve months of buying, up to 600€ earned with crypto trading is tax-free. This is according to rule 23 EStG, where private sales that do not exceed 600€ are tax exempted.

Buying cryptocurrency

Like in most parts of the world, there are no taxes on buying or HODLing cryptocurrencies in Germany. However, keeping accurate records of the purchase is very important so that you can calculate the cost basis of the transaction when you decide to sell or ‘dispose’ of your crypto.

Koinly is not just crypto tax software, but a crypto portfolio tracker too – the perfect tool to keep records of your crypto purchase and sale dates.

Staking more than 10 years

In Germany, crypto can be sold tax free if it was held for over 1 year. Previously, if you’ve used crypto in a staking/lending protocol, you’d need to hold this crypto for 10 years for it to be tax free. However, this has now changed to the same 1 year holding period as of April 2022.

Airdrops

In the context of an airdrop, a trader receives crypto without having purchased it or provided any other service for them. The cryptocurrencies are not transferred to the user from the legal sphere of a third party. Rather, they come into ‘existence’ only in the user’s assets. The cryptocurrency is created directly in the wallets of the users, and the wallets must fulfill certain criteria. In this respect, airdrops resemble a lottery win or a chance find (so-called windfall profits).

In the absence of a purchase transaction, taxation in accordance with Section 23 (1) No. 2 of the German Income Tax Act (EStG) is not possible in the case of a subsequent sale. If the user does not provide services, other income as defined by Section 22 No. 3 EStG is also not applicable. Therefore the sale of airdrops is tax-free.

Transferring crypto between wallets

Moving crypto between different exchanges, wallets or accounts is not a taxable event and doesn’t trigger income tax. Having said that, it’s important to keep track of these movements. Try an automated crypto tax software like Koinly to keep track of your cost-basis.

Calculating your crypto taxes with Koinly

Let’s look at how crypto tax is calculated in Germany to help us understand how Koinly can help.

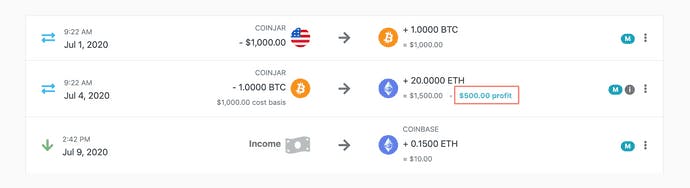

- Karim bought 1 BTC for 1000€ on 1st July 2020.

- He traded it for 20 ETH on 5th July 2020. The market value of 20 ETH at this point was 1500€.

- He also received 0.15 ETH (worth 10€) from Coinbase as a signup bonus.

To calculate the crypto taxes for Karim we are going to use Koinly which is a free online crypto tax calculator.

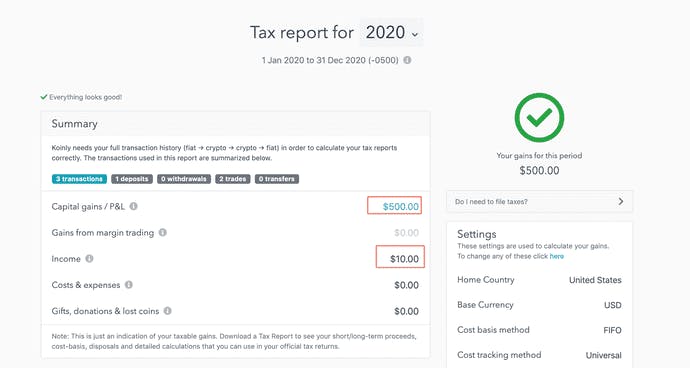

After entering the 3 transactions into Koinly manually, this is the output:

We can see the gain/loss on each transaction clearly. Navigating to the Tax Reports page also shows us the total capital gains.

As you can see, Karim will have a taxable capital gain of 500€ along with taxable income of 10€ from cryptocurrencies.

The good thing about crypto tax software is that whether you have 10 transactions or 10,000 – it is equally easy to generate your crypto tax reports! You can sign up for a free Koinly account and view your capital gains in a matter of minutes.

German cost basis method

The BMF guidance states that FIFO is the preferred method for calculating your crypto taxes. This means you sell the coins you bought first and use this to calculate your subsequent proceeds and profits.

How to pay less crypto tax in Germany

There are a few ways you can reduce your tax bill in Germany…

Deducting Cryptocurrency Losses & Trading Fees

The first step towards minimising your tax liability is figuring out what losses and expenses you can offset against your taxable income. Expenses could include

- gas fees

- ledgers

- wallets

- calculators

- training

Holding crypto for more than 12 months

You pay no tax if you hold your Bitcoin, Litecoin, Ethereum, Ripple, or other altcoins, for a period of over one year. No matter how much you make selling your cryptocurrencies, you don’t pay tax on gains if you’ve held them for over one year. You will only pay tax on short term gains.

Keep your short term and long term accounts separate

By separating your accounts into specific wallets or ledgers, say one for short term trades and one for the crypto you HODL, you can keep your data clean and manageable and avoid paying tax accidently.

Hacked or stolen cryptocurrency

However, you should record any losses as you can set off these losses with any future crypto profits within one year. In order to claim this loss, you need to be able to provide certain evidence. This includes:

- The wallet address that the key belongs to

- When you acquired the key and when you lost it

- The cost of acquiring the stolen/lost cryptocurrency

- The fact that the wallet was controlled by you

- The amount of cryptocurrency at the time that you lost the key

- That you possess the hardware where the wallet is stored

- The transactions to the wallet from an exchange which is linked to your identity

What happens if I don’t file my cryptocurrency taxes?

The BZSt is focused on ensuring all taxpayers meet their tax obligations. If you’re not sure whether you’ve correctly reported your crypto taxes over previous years, it’s best to be proactive and amend your previous tax reports.

Use Koinly to do your German crypto taxes

While the task of preparing your crypto taxes can seem quite daunting – especially if you traded on multiple exchanges – there are tools like Koinly which can make your life really easy.

Here’s how it works with Koinly so you can see for yourself:

Step 1: Connect your exchanges and wallets

Most exchanges have API’s that can allow Koinly to download your transaction history automatically. You can also import CSV or excel files with your transaction history if you prefer that (or if your exchange does not have an API).

Step 2: Preview your capital gains

Koinly does a number of things under the hood in order to calculate your capital gains and income.

First it fetches the market rates at the time of your trades, then it matches transfers between your wallets and exchange accounts and finally it calculates your capital gains. You can easily configure the accounting method used for the gains (it supports FIFO, LIFO, HIFO, Spec ID and a number of other methods). The default in Germany is FIFO as recommended by BMF guidance.

All this is automated so the only thing you have to do is head over to the Tax Reports page to see a summary of your gains:

Note that you can also use the Dashboard to stay on top of your taxes as you carry out trades. This can help you make good tax-friendly trades and avoid surprises at tax time! It also helps with record-keeping.

Step 3: Download your tax reports

The final step is to download your tax reports. The tax report you want is called the Complete Tax Report.

CURATED FROM:

“Germany Crypto Tax Guide 2022.” Koinly, 10 May 2022, https://koinly.io/guides/crypto-tax-germany/