Although China started to restrict the use of cryptocurrencies, primarily Bitcoin (BTC), as early as 2013, it has since unwittingly attained and maintained the status as a silent crypto ‘whale’, ironically, thanks to implementing its restrictive measures.

As a reminder, on December 5, 2013, the Chinese authorities moved to restrict the country’s banks from using Bitcoin as currency, specifying the concerns over money laundering and financial stability as the main reasons, The New York Times reported at the time.

Indeed, the directive, launched by the People’s Bank of China and four other ministries and agencies, stated that the move was required in order to “protect the status of the renminbi as the statutory currency, prevent risks of money laundering and protect financial stability.”

Crypto activities continue despite bans

The anti-crypto crusade continued, culminating in mid-2021, with a state-wide ban on all crypto-related services, which has failed to stop China from ranking as one of the top ten leading countries in crypto adoption.

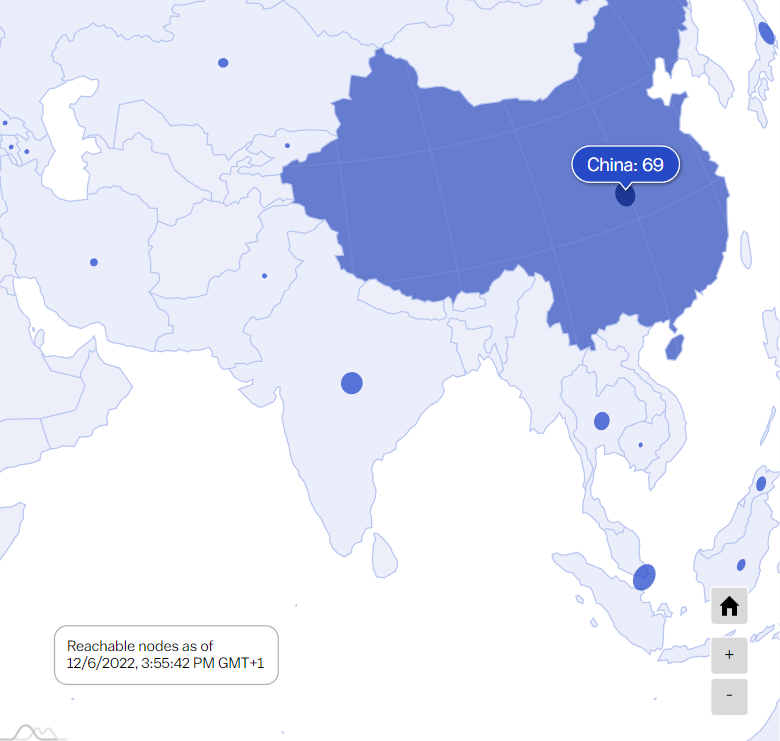

At the same time, the Bitcoin mining activities in China carried on, briefly interrupted by the period after the ban’s introduction, counting 69 reachable Bitcoin nodes as of December 6, according to the data by the crypto analytics platform Bitrawr.

Enough Bitcoin to tear down crypto market

Nine years after the original Bitcoin ban, it was revealed that China had so much crypto in its hands that it could shake the very foundations of the cryptocurrency market in a matter of seconds if its leadership chose to do so.

Specifically, after confiscating a large quantity of Bitcoin and Ethereum (ETH) from the Plus Token scheme in 2019, the Chinese government now holds 194,000 Bitcoin and 833,000 Ethereum.

In other words, 3,000 days after implementing the ban, the People’s Republic of China owns more Bitcoin than the likes of Michael Saylor’s MicroStrategy and Elon Musk’s Tesla, Inc. (NASDAQ: TSLA), according to BuyBitcoinWorldwide data retrieved on December 6.