JPMorgan Chase is betting that landlords and tenants are finally ready to ditch paper checks and embrace digital payments.

The bank is piloting a platform it created for property owners and managers that automates the invoicing and receipt of online rent payments, according to Sam Yen, chief innovation officer of JPMorgan’s commercial banking division.

While digital payments have steadily taken over more of the world’s transactions, boosted in recent years by the Covid pandemic, there is one corner of commerce where paper still reigns supreme: the monthly rent check. That’s because the market is highly fragmented, with most of the country’s 12 million property owners running smaller portfolios of fewer than 100 units.

As a result, about 78% are still paid using old-school checks and money orders, according to JPMorgan. More than 100 million Americans pay a combined $500 billion annually in rent, the bank said.

“The vast majority of rent payments are still done through checks,” Yen said in a recent interview.

“If you talk to residents to this day, they often say ‘The only reason I have a checkbook still is to pay my rent.’ So there are lots of opportunities to provide efficiencies there.”

Excel, QuickBooks

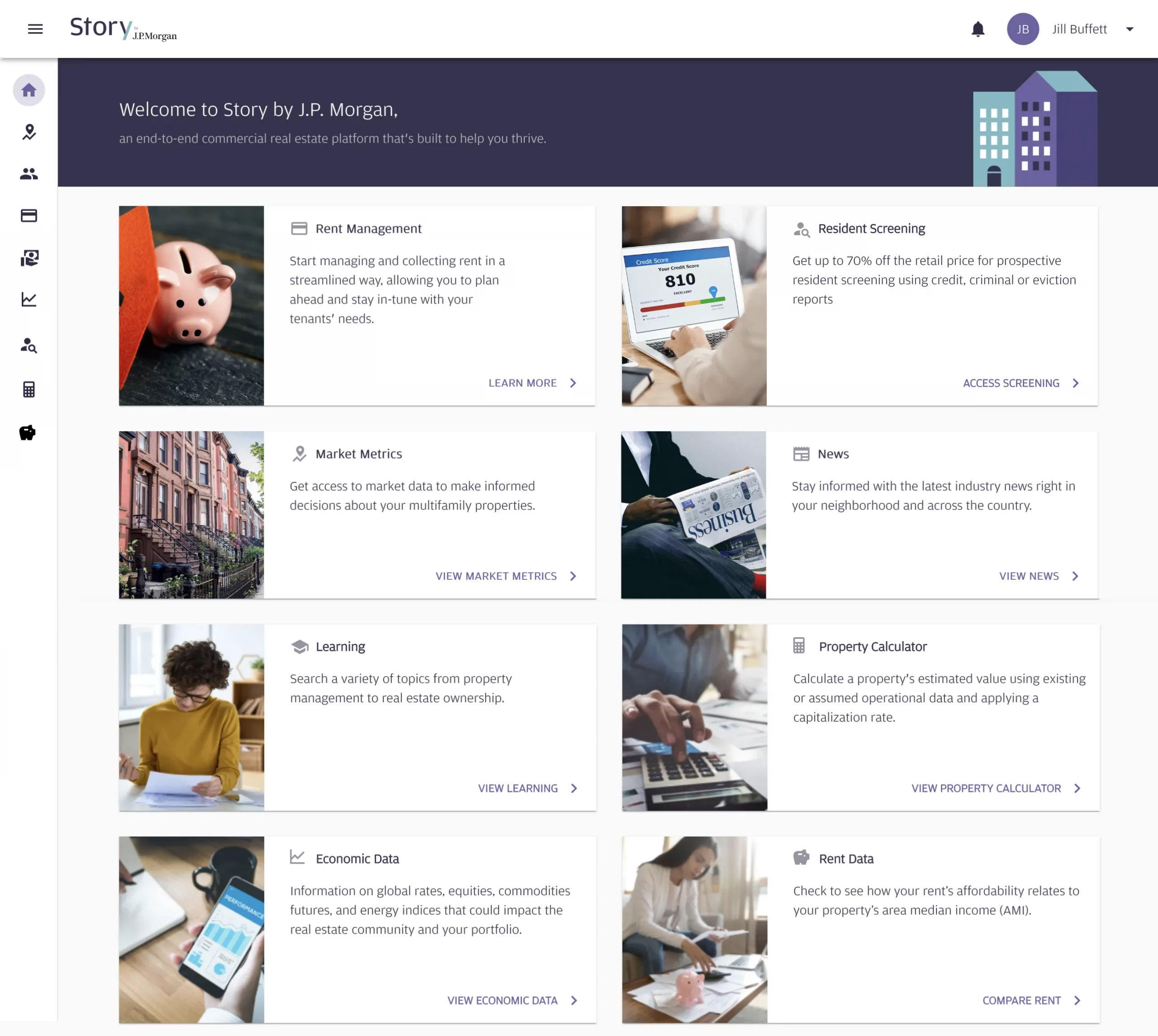

JPMorgan has spent the past few years working on the software, called Story, which is meant to ultimately become an all-in-one property management solution.

The bank aimed at first improving the rent collection process because it’s the “most time-intensive process that exists today for a real estate owner-operator,” according to Kurt Stuart, who runs JPMorgan’s commercial term lending for the Northeast region.

Besides having to manually collect paper checks and depositing them, landlords typically lean on decades-old software including Microsoft’s Excel and Intuit’s QuickBooks to run their businesses, said Yen. Newer options more tailored to the real estate industry have appeared in recent years with names like Buildium and TurboTenant. None are dominant yet, according to the executive.

Story will “give [property owners and managers] much more visibility across their entire portfolio to see exactly what’s been paid and what hasn’t been paid,” Yen said.

JPMorgan hopes to gain traction by offering users valuable insights through data and analytics, including how to set rent levels, where to make future investments and even assist in screening tenants, according to Yen.

While the bank says it is the country’s top lender to multifamily property owners with $95.2 billion in loans out at midyear, it is aiming beyond its 33,000 clients in the sector.

Landlords and renters don’t have to be JPMorgan customers to sign up for the platform when it is released more broadly next year, said Yen. The bank hasn’t yet finalized its fee structure for the product, he said.

Residents can automate monthly rent payments, receive notifications, and view their payment history and lease agreement through an online dashboard. That provides ease of mind versus mailing out a paper check, Yen said.

Digital push

It’s part of JPMorgan’s larger drive to create digital experiences, fend off fintech rivals and solidify client relationships. Under CEO Jamie Dimon, the bank has committed to spending more than $12 billion a year on technology, a staggering figure that has raised eyebrows among bank analysts who called for greater clarity into investments this year.

JPMorgan hopes to move beyond making loans to property owners to eventually capture “a significant portion” of the $500 billion in annual rent payments with its software, commercial banking CEO Doug Petno told analysts in May.

“We’ve been investing to build comprehensive payments and rent solutions capabilities specifically for our multifamily clients,” – Petno

“In doing this, we hope to create an entirely new and substantial revenue opportunity for our business.”

CURATED FROM:

Son, Hugh. JPMorgan Chase wants to disrupt the rent check with its payments platform for landlords and tenants. 31 Oct, 2022, https://www.cnbc.com/2022/10/31/jpmorgan-chase-unveils-payments-platform-for-landlords-and-tenants.html?__source=sharebar%7Clinkedin&par=sharebar.