The world of crypto has seen a marked evolution in its view on token issuance.

Tokenomics, the study of the economic framework surrounding a cryptocurrency or a project’s ecosystem, is pivotal for digital asset investors. Essentially, tokenomics revolves around the design, generation, distribution, and management of a project’s tokens. This system influences a token’s economic value and holder incentives. The science of tokenomics amalgamates diverse fields such as economics, game theory, and blockchain intricacies.

In essence, tokenomics delineates the functionality, fiscal policy, distribution strategy, and incentives related to a project’s token. Efficient tokenomics fosters a flourishing ecosystem, whereas a flawed approach might render it unstable.

A paramount aspect of tokenomics, especially for those diverging from mainstream assets like Bitcoin and Ethereum, is token issuance. This strategy is usually adopted to mobilize capital for purposes such as growth, debt reduction, or novel ventures.

When a project rolls out new tokens, investors should account for:

- Ownership Dilution: Issuance of new tokens can reduce the control percentage of current holders, affecting the perceived or actual value of each token.

- Allocation of Proceeds: If the acquired funds are channeled towards the protocol’s growth and strategic pursuits, it could elevate the token’s prospective value. However, a perceived misuse or unplanned deployment can be seen negatively.

It’s essential to consider potential information asymmetry and agency issues between protocol developers and token holders. Like traditional businesses, protocol teams may have undisclosed information about their projects. This creates an environment ripe for “managerial market timing,” where insiders base their token transactions on their forecasts of future token price movements. Investors must be vigilant about the actions of a project’s foundational team, especially if it seems misaligned with the project’s declared objectives.

Analyzing the digital market’s historical reaction to token issuance using data from the CoinDesk Market Index, I observed a significant amount of token issuance during the 2020-2021 crypto boom, with peak issuance in early 2021. However, token issuance dipped by more than half in the subsequent 2022-2023 bear market.

Figure 1: Net Token Issuance across CoinDesk Markets Index (CMI) Universe, Percentiles of Net Token Issuance; Date Range: January 2020 – August 2023; Source: CDI Research

This synchronization of token issuance with the bullish market indicates a positive investor sentiment, perhaps coupled with some strategic timing by crypto insiders.

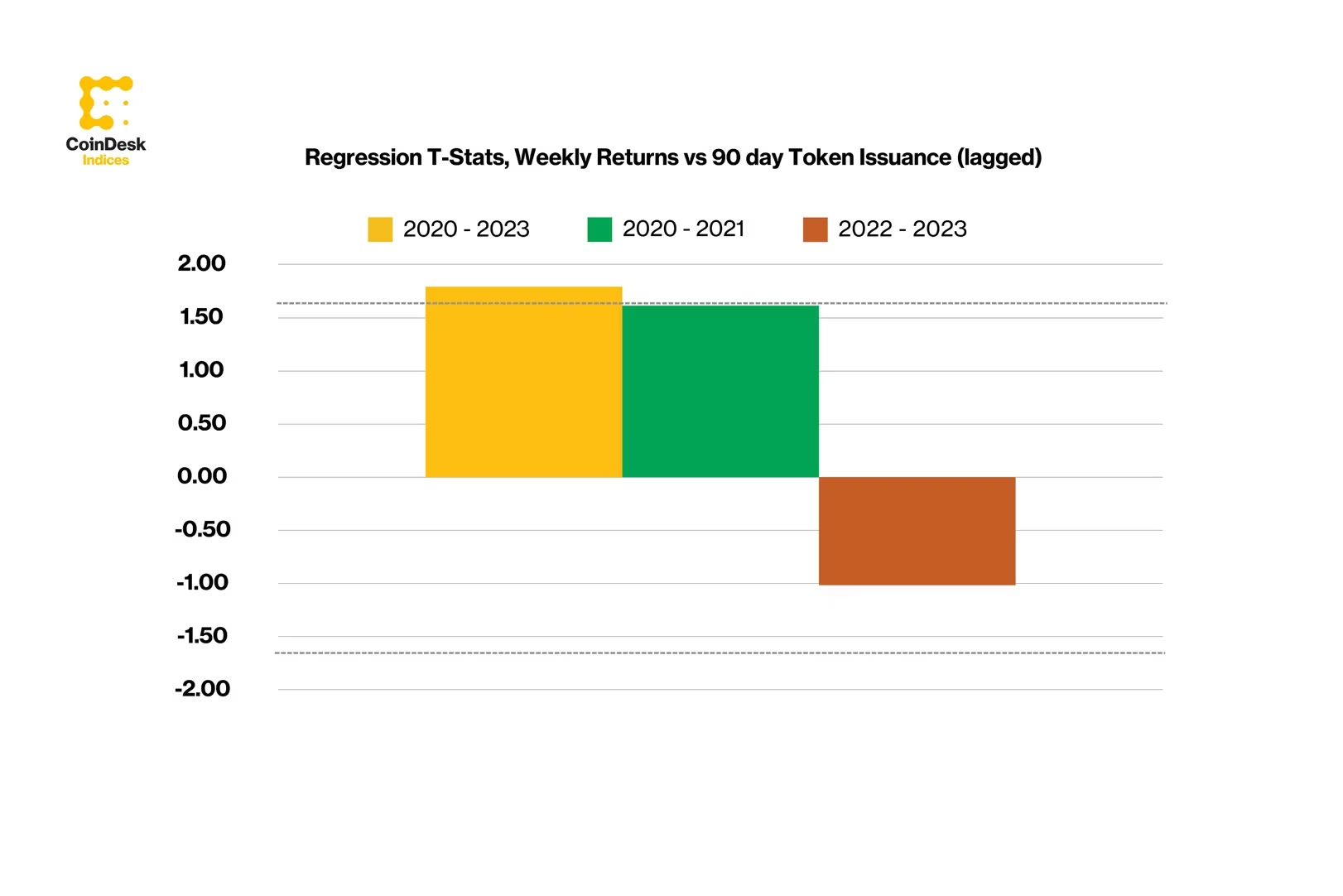

Figure 2: Multivariate regression results of weekly token returns versus lagged percentage change in 90-day token supply, controlled for momentum and crypto market risk factor. T-stat is shown only for lagged token issuance independent variable. Dashed lines highlight 10% confidence interval bands. Date range: January 2020 to August 2023. Source: CDI Research

Furthermore, a regression analysis of weekly crypto returns against the preceding week’s annualized token issuance from 2020 to August 2023 showed a shift in investor sentiment. While token issuance was once viewed favorably during bull markets, it has turned neutral or even negative post-market peak, with investors weighing the effects of token dilution against the growth potential.