As the United States Securities and Exchange Commission (SEC) continues to intensify its crackdown on some of the largest businesses in the cryptocurrency sector, including filing lawsuits against Coinbase and Binance, it has profited plenty from its enforcement efforts.

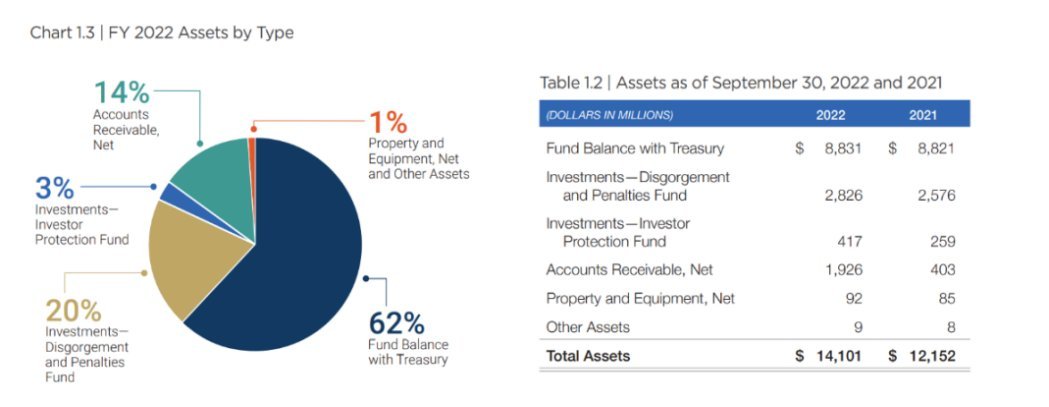

Specifically, as per the annual report for the fiscal year 2022, the regulatory agency generated an income of $14.1 billion during that period, which is an increase of $1.9 from $12.2 billion in 2021, as shared by Twitter user Wu Blockchain on June 12.

Enforcement activities

According to the document, most of these assets had come from confiscated income in the SEC’s enforcement actions, which, as per the SEC’s press release from November, in the fiscal year 2022 increased by 9% compared to the year before, as the agency brought 760 enforcement actions in 2022.

As it happens, these included 462 new or “stand-alone” actions and ordered payments totaling $6.4 billion, which represents the highest amount of such penalties in the history of the agency, in addition to demonstrating an increase of $3.9 billion from 2021.

Although the report did not specify how much of these assets the agency confiscated from cryptocurrency businesses, it did note that the SEC had forced the crypto exchange BlockFi to pay a $50 million penalty over “failing to register the offers and sales of its retail crypto lending products” and failing to register as an investment company.”

Furthermore, according to the October statement by the Office of Inspector General, the SEC had announced the allocation of 20 additional positions for the Crypto Assets and Cyber Unit of its Enforcements division, “nearly doubling its size, as the volatile and speculative crypto marketplace has attracted tens of millions of American investors and traders.”

Meanwhile, the SEC is in the middle of a tumultuous legal battle against blockchain company Ripple, which it accuses of illegal sales of the XRP token that the agency views as unregistered securities. However, the controversial documents, which will become publicly available on June 13, reveal that the SEC is not entirely unified in its position.