Crypto prices were in the green on Monday while stocks declined across the board. Grayscale’s ether trust hit a new low.

Bitcoin has been trading above $17,000 since about noon EST on Sunday, according to TradingView. The leading cryptocurrency by market cap was up 0.3% to $17,087 at 10:45 a.m. EST today. The price of bitcoin began to show weakness shortly after 10:00 a.m. EST, dropping below $17,200.

Ether ticked higher by over 0.5%, trading at $1,266. Elsewhere, Binance’s BNB was up 0.5%, and Ripple’s XRP rose by 0.2%. Litecoin experienced more significant gains, tacking on over 7% in the past 24 hours.

The U.S. Dollar Index was trading at 104.83, its lowest level since August; bitcoin’s price in dollars tends to move higher when the dollar weakens. The U.S. dollar has shed over 50% of its gains made this year as traders bet on the Fed slowing the pace of its interest rate hikes. The probability, based on Fed funds futures pricing data, of a 50 basis point increase on Dec. 14 is now 77%, according to the CME Group’s FedWatch tool.

Crypto stocks and structured products

The S&P 500 fell by 0.8%, and the Nasdaq 100 dipped by 0.7%.

Coinbase shares were trading around $47, down 0.9% at 10:45 a.m. EST, according to Nasdaq data. Silvergate shares sank 5.2% shortly after the open in New York.

Block was also down, dipping 4.7% to $64.92, while MicroStrategy shed over 5% to $195. Michael Saylor’s firm opened the week above $200.

Grayscale’s closed-end bitcoin fund, GBTC, was trading at a discount of 42.3%. The discount on the asset manager’s ETHE product fell to a new all-time low of 45.7%.

Both of the funds trade at a discount to the net asset value (NAV), as shares in the fund don’t grant the holder access to the underlying assets. Shares had traded at a premium until early 2021.

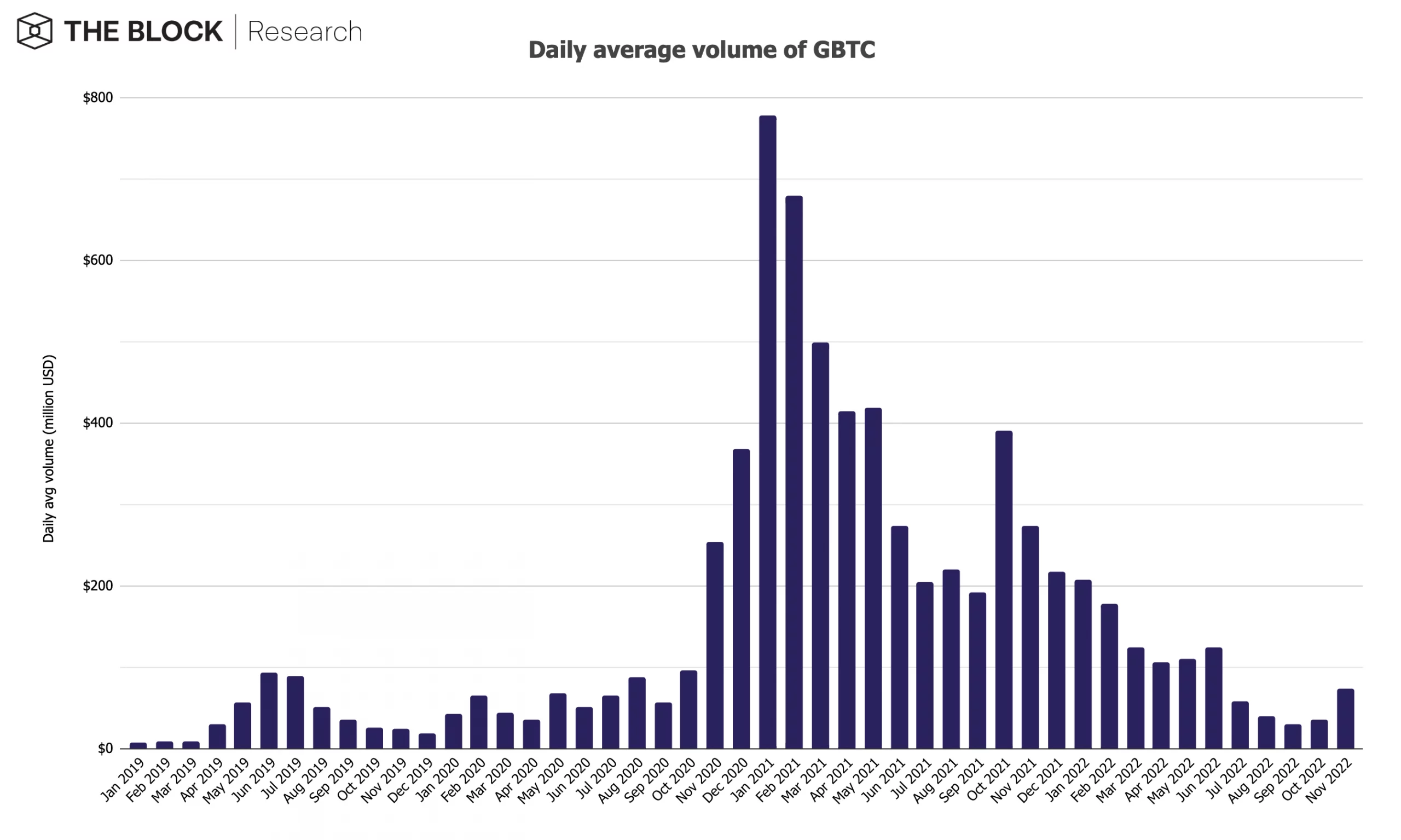

The daily average volume of GBTC increased by 17% to $36 million in October from the previous month, according to The Block Research.