Bitcoin price stays flat after a few jumps in the past week.

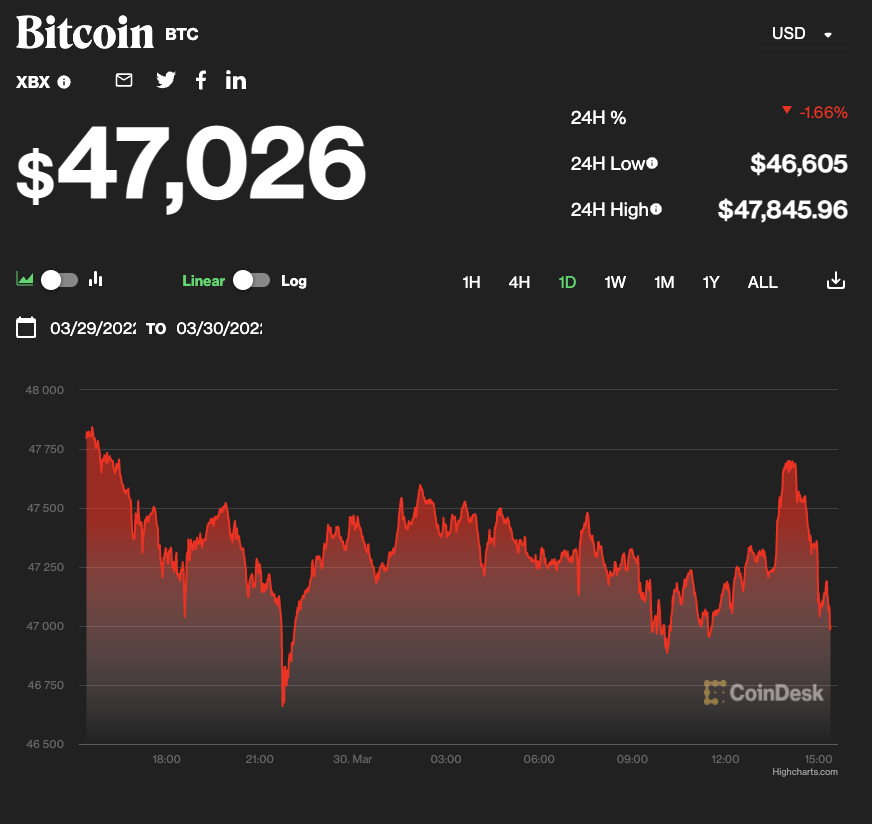

The bitcoin price was around $47,026 as of press time, down 1.67% from yesterday. (CoinDesk)

Bitcoin (BTC) was on the verge of a nine-day winning streak – but barely, as the largest cryptocurrency’s recent price momentum appeared to slow.

The bitcoin price was around $47,026 as of press time, down 1.67% from yesterday.

The cryptocurrency had climbed for eight consecutive days, lifting the price from about $40,000 and reaching a new 2022 high around $48,200 on March 28.

-

“Based on recent price action, it looks like BTC is consolidating within a range and has room to move higher,” blockchain analytics platform Nansen told CoinDesk. “There are other clear indicators that risk appetite in the market has increased.”

-

According to Nansen, Ethereum gas fees have been very high recently, which has typically been a solid indicator of a shift to more risk-on investor behavior.

-

“Bitcoin dropped in the early hours of the morning, after the largest blockchain game Axie Infinity suffered a $625 million hack,” wrote Global Block in its newsletter. “The dip has been bought up as bitcoin remains above $47,000, showing great strength amongst the news of the hack.”

-

The hack happened in cross-chain bridges that are secured by only one centralized computer.

-

MacroStrategy, a wholly-owned subsidiary of the enterprise analytics and mobility software provider MicroStrategy (MSTR) that invests in bitcoin as its central business strategy, has obtained a $205 million loan collateralized by bitcoins from Silvergate Bank.

-

MacroStrategy can use the loan to purchase bitcoin or pay interest and fees related to the loan or for its or MicroStrategy’s general corporate needs.

-

Luna Foundation Guard (LFG), a non-profit organization focused on UST, resumed buying the largest cryptocurrency after taking a break on Tuesday. It has purchased 5,773 BTC, worth $272 million, this week.

-

“The buy pressure of MicroStrategy and Luna Foundation Guard is understandably contributing to a strong uptrend in the short-term,” Global Block wrote.

-

“It could be a simple lull now that MicroStrategy and Terra have paused their buying at this moment” said Jason Deane, chief bitcoin analyst at Quantum Economics. “But it could also be a period of simple consolidation after an eight day run.”

-

If it is a consolidation, “these are often considered a bullish indicator, as it gives the market time to build a new base on which to make further price discovery,” Deane told CoinDesk.

-

Deane also said that the number of HODLers, who stick to a buy-and-hold strategy, is increasing rapidly – a positive sign for the price of bitcoin. This also signifies the confidence of long-term bitcoin holders.

CURATED FROM:

Chen, Angelique. “Bitcoin Flirts with 9-Day Winning Streak, Nears $48K.” CoinDesk Latest Headlines RSS, CoinDesk, 30 Mar. 2022, https://www.coindesk.com/markets/2022/03/30/bitcoin-flirts-with-9-day-winning-streak-nears-48k/.