United States-based crypto startups attracted 45% of all venture capital funding invested in the crypto industry, followed by the United Kingdom (7.7%) and Singapore (5.7%).

Despite facing regulatory scrutiny in the United States, crypto firms continue to innovate, with nearly half of all capital investments flowing toward U.S. crypto businesses, according to a recent report.

Published by crypto investment firm Galaxy Digital on July 14, the report stated that U.S.-based crypto startups had a significant share of interest from venture capital (VC) firms.

“US-based crypto startups accounted for more than 43% of all deals completed and raised more than 45% of the capital invested by VC firms.”

The United Kingdom took 7.7% of capital investment, with Singapore and South Korea attracting 5.7% and 5.4%, respectively.

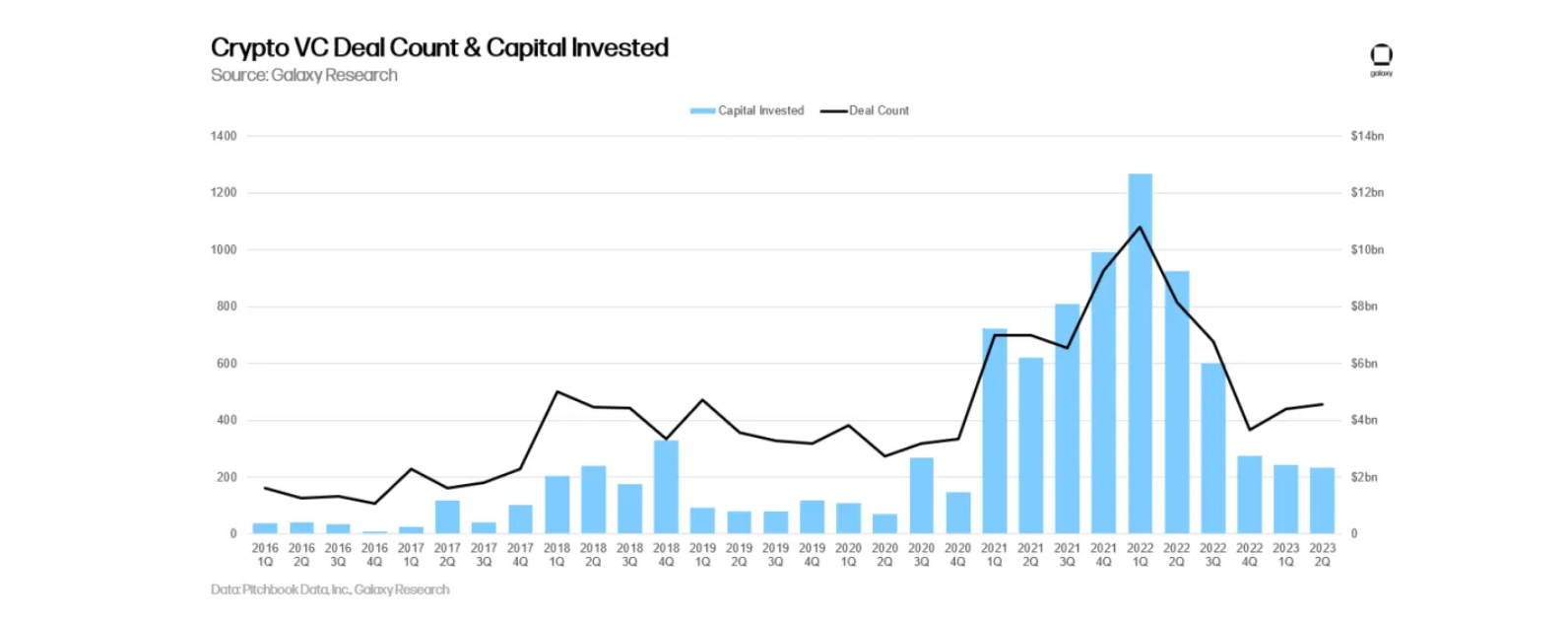

However, it was noted that the total amount of capital invested in crypto and blockchain startups continued to decline quarter-to-quarter.

“Only $720m was raised by 10 new crypto VC funds in Q2 2023,” it noted, pointing out that this is the lowest since the beginning of the COVID-19 pandemic in the third quarter of 2020.

“Crypto and blockchain startups raised less money across the last three quarters combined than they did in just Q2 last year.”

It was further noted that while companies in the “broad Web3 category” had more deals, companies in the “trading category” raised more capital.

This comes amid the United States Securities and Exchange Commission (SEC) taking action against several U.S. crypto firms in recent times.

On July 13, in the case between the SEC and Ripple Labs, a judge ruled partially in favor of the payments and technology company by declaring XRP is not a security when sold on digital asset exchanges.

On June 18, Cointelegraph previously reported that Ripple CEO Brad Garlinghouse believes the SEC is “looking to kill” innovation and the cryptocurrency industry in the United States.

Garlinghouse argued that the SEC’s handling of the Hinman speech documents during the Ripple case isn’t about “any one token or any one blockchain,” but more the overall stance that the SEC has taken toward the crypto industry.

Garlinghouse’s comments came after the SEC took action against major crypto exchanges Binance and Coinbase only a day apart on June 5 and 6, alleging a violation of securities laws and offering unregistered securities.